Enter the Mission Lane Credit Card, a financial tool designed specifically for those seeking to rebuild their credit. The Mission Lane Credit Card login portal serves as a gateway to financial empowerment, providing users with a comprehensive view of their accounts, enabling them to make informed decisions and manage their credit responsibly.

With every timely payment and responsible credit utilization, Mission Lane cardholders take a step closer to a brighter financial future. The login portal becomes a symbol of progress, a testament to their commitment to financial health. It’s more than just a login page; it’s a stepping stone on the path to financial freedom.

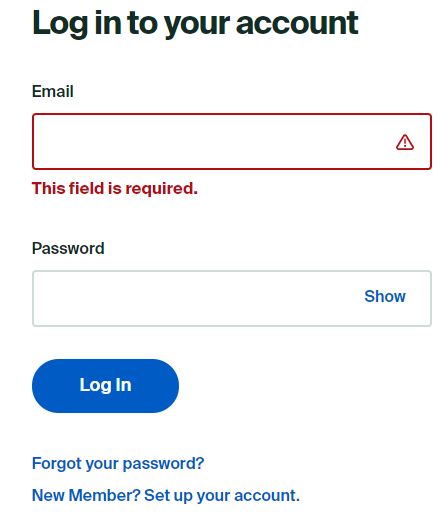

Mission Lane Credit Card Login

- First of all, visit the login page

- Now enter your email and password

- Press login button

- And get login

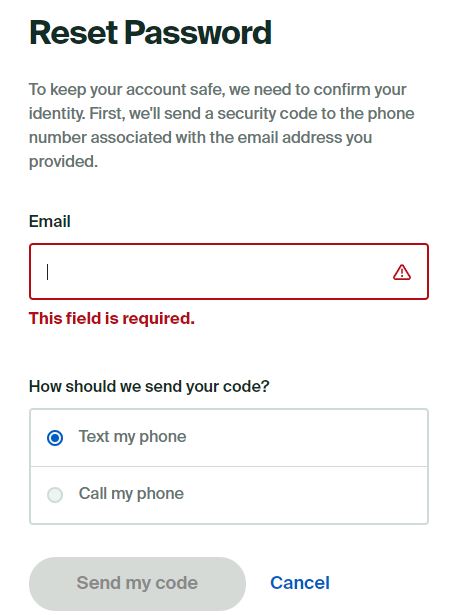

How To Reset Mission Lane Credit Card Login Password

To reset your password, follow these steps:

- Navigate to the Mission Lane login page

- Click on “Forgot your password?”

- Enter your email address

- Choose your verification method

- Receive and enter the security code

- Create a new password

- Confirm your new password

- Complete the password reset

How To Register For Mission Lane Credit Card Login Account

To register for a Mission Lane credit card login account, you’ll need to have already applied for and been approved for a Mission Lane credit card. Once you have your card, follow these steps to create your online account:

1. Visit the Mission Lane website

2. Click on “New Member? Set up your account”

3. Enter your card details

4. Create your account

5. Confirm your account details

6. Complete the registration

Mission Lane Credit Card Pre-Approval

Yes, Mission Lane offers a pre-qualification process for their Visa® Credit Card. This process allows you to see if you’re likely to be approved for the card without a hard credit inquiry, which can temporarily impact your credit score.

To check your pre-qualification status, you can visit the Mission Lane website and fill out a brief form with basic personal and financial information. Mission Lane will then perform a soft credit inquiry, which won’t affect your credit score, and provide you with a pre-qualification decision within minutes.

If you’re pre-qualified, you’ll see the potential credit limit and APR you may qualify for. You can then decide whether to proceed with a formal application. If you choose to apply, Mission Lane will perform a hard credit inquiry, which will be reflected on your credit report.

Mission Lane Credit Card Reviews

The Mission Lane Visa® Credit Card is a credit-building card designed for individuals with limited or fair credit. It offers an opportunity to establish or improve credit history without requiring a security deposit. However, it does have a variable annual fee ranging from $0 to $59, depending on creditworthiness.

Here’s a summary of the card’s pros and cons:

Pros:

- No security deposit required

- Potential for credit limit increases

- Reports to all three major credit bureaus

- Easy-to-use mobile app

Cons:

- Variable annual fee up to $59

- High APR

- No rewards program

- Limited customer service options

Mission Lane Credit Card Limit

The credit limit for the Mission Lane Visa® Credit Card typically starts at $300 for those with limited or fair credit. However, the exact credit limit is determined on a case-by-case basis, considering factors such as your credit history, income, and debt-to-income ratio.

If you use your card responsibly and make timely payments, you may be eligible for a credit limit increase within six months of opening your account. Mission Lane may also periodically review your account for potential credit limit increases.

To request a credit limit increase, you can contact Mission Lane customer service or submit a request through your online account. Mission Lane will evaluate your request based on your creditworthiness and account history.

Mission Lane Credit Card App

Yes, Mission Lane offers a mobile app for their credit cardholders. The app is available for both iOS and Android devices and provides a convenient way to manage your credit card account on the go.

Here are some of the features of the Mission Lane Credit Card app:

- View your account balance and recent transactions: Keep track of your spending and payment history.

- Make payments: Pay your credit card bill directly from the app using a linked bank account or debit card.

- Set up recurring payments: Schedule automatic payments to avoid late fees and maintain a good payment history.

- View your credit score: Monitor your credit score and track its progress over time.

- Receive account alerts: Get notifications about important account activity, such as payment reminders, fraud alerts, and credit limit increases.

- Access customer support: Contact Mission Lane customer service directly through the app’s secure messaging system.

Mission Lane Credit Card Phone Number

The primary customer service phone number for Mission Lane credit card is 1-855-790-8860. This number is available for general inquiries, account assistance, and reporting lost or stolen cards.

Conclusion

As you embark on your journey to financial empowerment with Mission Lane, remember that their online account access and mobile app are your allies in managing your credit card effectively. 😊 Whether you’re checking your balance, making payments, or reviewing your credit score, these tools put you in control of your financial well-being. 💪

Thank you for taking the time to learn about Mission Lane’s online and mobile banking options. Your commitment to financial literacy is commendable! 👏 Remember, responsible credit card usage can open doors to a brighter financial future. 🔑

For more details visit the https://cardlogine.com/